Government Schemes of West Bengal – Egiye Bangla

Pradhan Mantri Awas Yojana Urban – PMAYU at pmaymis.gov.in

Pradhan Mantri Awas Yojana Urban 2024 (pmaymis.gov.in): How to apply for Pradhan Mantri Awas Yojana Urban? Benefit and Registration Process of Pradhan Mantri Awas Yojana Urban Online.

Providing the benefit of pucca houses to all of the residents of the country by 2024, PM Modi started the (PMAY) Pradhan Mantri Awas Yojana in 2015. Under this scheme, which is being implemented as a mission, a poor person in an urban area can get a house constructed in a 30-square-meter carpet area.

| Pradhan Mantri Awas Yojana Urban Overview | |

|---|---|

| Name of the scheme | Pradhan Mantri Awas Yojana Urban |

| Started by | PM Narendra Modi |

| Government | Central government |

| Beneficiary | Poor Person |

| An objective | A poor person in an urban area can get a house |

| Start plan | 25-Jun-2015 |

At the same time, under this scheme, people of the low-income groups (LIG) and middle-income groups (MIG) can fulfill the dream of their residence by taking loans at low interest rates.

The scheme is implemented by way of the State Governments or Union Territory Governments and the Central NOID Company. The biggest feature of the scheme is that the woman of the family is made the owner of the house.

What is the Credit Link Subsidy Scheme (CLSS)?

CLSS is the only credit link subsidy scheme being run for the middle-income group. This was earlier till 2017, which was increased to March 2025. Then it was increased to December 2025.

Below this scheme, a curiosity subsidy of Rs 2.67 lakh is given to the economically weaker part.

Who will get the benefit of the Prime Minister Housing Scheme (PMAY)?

The basic goal of this scheme is to provide housing to all. Therefore, those who already have a home or whose family members have a home, will not get the benefit. It clearly states that the beneficiary shouldn’t have a pucca house. On this, the family can also be defined. The family consists of spouses and unmarried children.

What are EWS, LIG, and MIG categories?

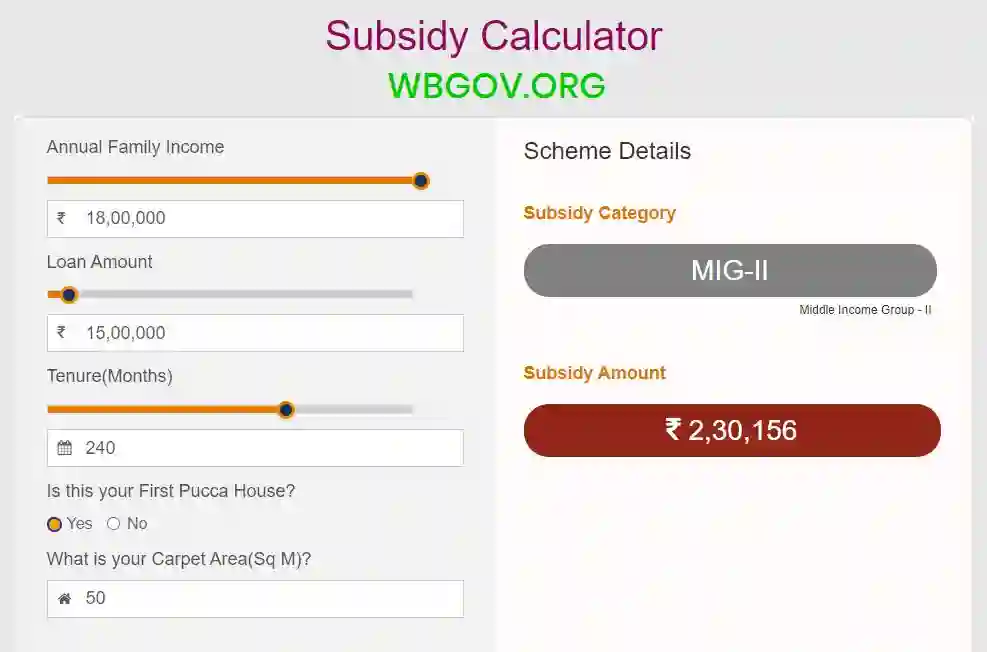

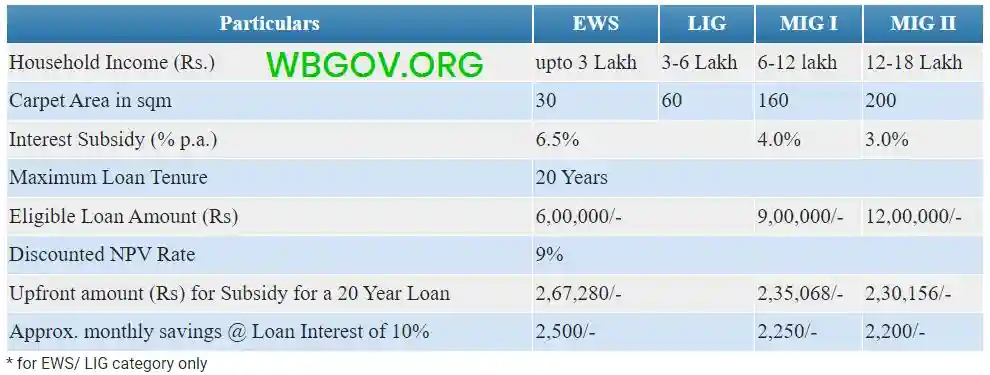

A family with an annual revenue of less than three lakh rupees falls within the Economically Weaker category (EWS). After this, LIG family with 3 to 6 lakh annual income and family with 6 to 12 lakh annual income fall in the MIG-1 category.

A household with an income of 12 to 18 lakhs yearly falls within the MIG-2 category. In the MIG-1 and MIG-2 categories, there is a 4 percent curiosity subsidy on loans up to Rs 9 lakh and a 3 percent interest subsidy on loans up to Rs 12 lakh.

How does the PMAY scheme work?

For example, you fall in the MID-2 class and you want to buy a house worth 60 lakh rupees. For this, you pay 20%, i.e. 12 lakh rupees in cash, and take the remaining amount, i.e. 48 lacks mortgage.

But under the PM Awas Yojana, you’ll get a 3 % interest subsidy only on a loan of Rs 12 lakh. In this way, regular interest will be charged on the remaining loan amount of Rs 36 lakh.

Will this scheme benefit building a house on an empty plot?

The answer is sure. Below this, the beneficiary will get an interest subsidy. In this scheme, 160 sq. meter carpet area has been kept for the MIG-1 category, while 200 sq. meter carpet area has been kept in MID-2

This is how the PMAY plan works.

In the Credit Linked Subsidy Scheme (CLSS), people of the center income group whose annual income is between 6 lakhs and 12 lakh rupees, will get a 4% interest subsidy on a 20-year term home loan of 9 lakh rupees.

For instance, if the rate of interest on a home loan is 9 %, then you’ll have to pay only 5 % under PMAY. People with an annual income of Rs 12 lakh to Rs 18 lakh will get a 4% interest subsidy

For instance, if the rate of curiosity on a home mortgage is 9 %, then you will have to pay solely 5 % under PMAY. Those with annual earnings of Rs 12 lakh to Rs 18 lakh will get an interest subsidy of 4 percent.

4 categories under the scheme

Economically Weaker Section (EWS) and Decrease Income Group (LIG) with 3 lakhs to 6 lakhs annual income, Middle Income Group 1 (MIG1) with 6 lakhs to 12 lakhs annual income, and Middle Income Group 2 (with 12 lakhs to 18 lakhs annual income).

Economically Weaker Part (EWS), Lower Income Group (LIG) will proceed to get the benefit of credit-linked subsidy until 31 December 2025. But Middle Income Group 1 (MIG1) and Middle Income Group 2 (MIG2) got this profit only by applying till 31 December 2025. However, there’s a demand for extending the subsidy profit to each of these teams by 31 December 2025.

When you also must take advantage of cheap homes under the scheme and you wish to apply after the lockdown, then you must have these documents

For salaried class

Identity proof

- It’s necessary to have a PAN card.

- Apart from this, any voter ID, Aadhar card, passport, driving license, or government ID proof.

- Address proof

- Voter card, Aadhar card, Passport, Life insurance coverage policy, residence address certificates, lease agreement on stamp paper, bank, passbook, income proof, final 6 months bank statement, ITR receipt, last 2 months salary slip

For non-salaried

Identity proof

- It’s necessary to have a PAN card.

- Apart from this, Voter ID, Aadhar Card, Passport, Driving License, and any government ID

Address proof

- Voter Card

- Aadhar Card

- Passport

- Copy of utility bill, which can contain phone bill, fuel invoice, and electricity bill.

- The last three months’ bank statements from Commercial Nationalized Bank

- Address on savings account in the post office

- life insurance policy

- Residence Address Certificates

- Rent agreement on stamp paper

- The address was written on the bank passbook

Address proof in case of the owner of shop, firm, company….

• store and institution certificates

• trade license certificates

• SSI registration certificates

• pan card gross sales tax/VAT certificates

• partnership deeds in case of being agency factor registration certificates

• export-import code certificate income

Income proof for non-salaried

- ITR of last 2 years

- Balance sheet

- Last 6-month bank statement of current and saving

For property proof

- Property Documents

- Copy of agreement

- Allotment letter

- Payment Receipt

- buyer agreement

PMAY extended time

Housing and Urban Development Secretary Durga Shankar Mishra said that the Credit-Linked Subsidy Scheme has been prolonged until 31 December 2025. To achieve the goal of housing for all by the year 2025, the government has prolonged the period for availing PMAY.

Where can you benefit from it?

Banks, housing finance firms, regional rural banks, small finance banks, and many institutions are offering customers benefits from this scheme. National Housing Bank (NHB) and HUDCO (HUDCO) are also included in this scheme.

Help & Support

Know the latest West Bengal schemes offering financial aid, social welfare, and development benefits. Learn about eligibility, applications, and key features focused on education, employment, and healthcare.

© 2024 Latest Schemes of West Bengal - wbgov.org